Thursday, November 6, 2008

Equity Technical Update #2008 - 12

Update: NASDAQ ACT Defines New Market Maker Trade Entry and Unsolicited Messages

Please Route To:

Head Traders; Technical Contacts; Compliance Officers Clearing Contacts?

What you need to know:

- As announced in Head Trader Alert #2008-084, an enhanced Market Maker Trade Entry Function G has been created to support the new ACT functionality.

- NASDAQ has received Securities and Exchange Commission (SEC) approval for SR–NASDAQ–2008–033 to offer new voluntary functions for NASDAQ Exchange members on the NASDAQ ACT system.

- NASDAQ has updated the CTCI and FIX for Trade Reporting specifications on the NASDAQ Trader website.

- The new trade entry fields to support these functions are currently available on the NASDAQ Workstation and Weblink ACT 2.0 and specifications have been updated.

Who you should contact:

NASDAQ Technical Support +1 212 231 5180

What is changing within ACT?

NASDAQ® has received Securities and Exchange Commission (SEC) approval for enhanced Market Maker Trade Entry Function G. Refer to Head Trader Alert #2008-124.

Use of the new fields and functions is voluntary.

How will FIX and CTCI for Trade Reporting change to support these functions?

A new Market Maker Trade Entry Function G has been created, along with complimentary Unsolicited Message (UM) layout.

The following new fields have been introduced:

- Trade Reference Number

- Intended Market

- Related Market

The following new values have been introduced for Clearing Flag:

- S = NASDAQ QSR for clearing

- A = NASDAQ AGU for clearing

The following new Risk values are available to better manage inclusion of transactions in NASDAQ Credit Risk Management calculations:

- U = AGU clearing, not risk eligible

- R = Risk update only, not sent to clearing

- Y = Clearing, non-risk eligible

NASDAQ recommends firms do not adopt any of these “Risk” values immediately. NASDAQ will be communicating directly and through risk managing Clearing Firms as to the best use of these values based on firms’ Trade Reporting and Clearing models.

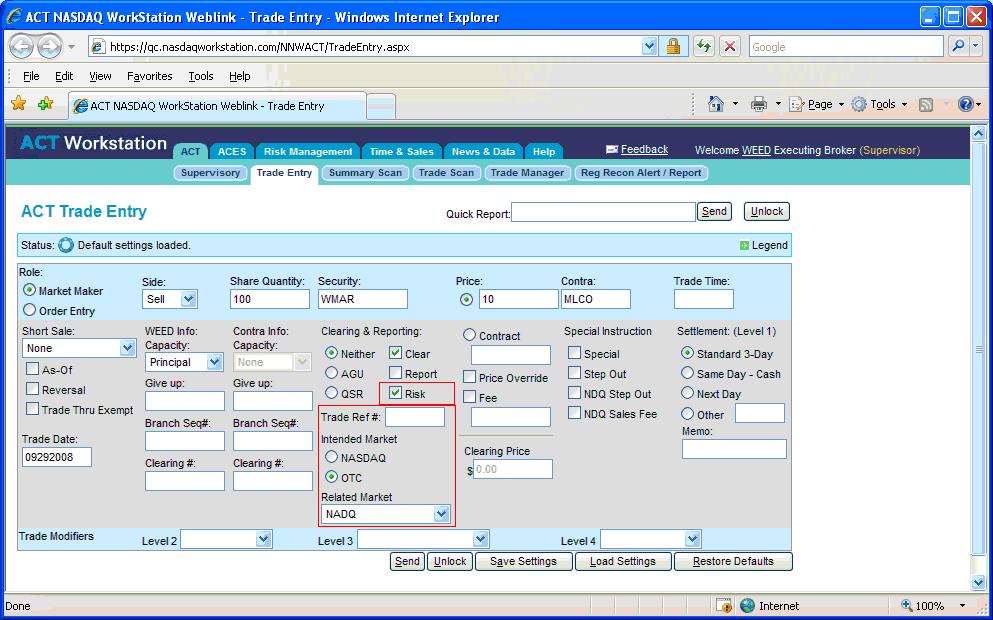

How will NASDAQ Workstation and WeblinkACT 2.0 Trade Entry change to support these functions?

The Market Maker Trade Entry window has been redesigned to offer new NASDAQ Exchange trade reporting capabilities.

The following new fields have been introduced:

- Trade Reference Number

- Intended Market

- Related Market

- Risk

Note: The Risk flag is the how the NASDAQ Workstation® expresses the Risk values described above, and will automatically check and uncheck as the “Clear” field is checked and unchecked, which mimics the previous convention where clearing eligible records only were included in Risk Calculations. The Risk field can be checked and unchecked by the user and will not impact the state of the “Clear” field.

The following new capacity value has been introduced:

- Intrabroker

What do I need to do?

- FIX and CTCI users can obtain the updated programming specifications from the NASDAQ Trader® website.

- FIX and CTCI users can upgrade to the new UM message format by contacting NASDAQ Subscriber Services at +1 212 231 5180.

Where can I find additional information?

- Refer to SR–NASDAQ–2008–033, Head Trader Alert #2008-124 and Head Trader Alert #2008–84.

- Contact NASDAQ Technical Support +1 212 231 5180.

Email Alert Subscriptions:

Nasdaq offers customers the ability to self select news delivery across various Nasdaq markets. Create and maintain a profile for updating alert preferences and contact information. Visit the enrollment form on the Nasdaq Trader website and sign up today! Please note that if you choose to unsubscribe from an email list, you may no longer receive potentially critical emails from the NASDAQ Stock Market regarding Nasdaq's trading and data products, regulatory issues or marketplace initiatives. To unsubscribe, also click on the enrollment form

Please follow Nasdaq on ![]() Facebook

Facebook ![]() RSS and

RSS and

![]() Twitter.

Twitter.

Nasdaq (Nasdaq: NDAQ) is a leading global provider of trading, clearing, exchange technology, listing, information and public company services. Through its diverse portfolio of solutions, Nasdaq enables customers to plan, optimize and execute their business vision with confidence, using proven technologies that provide transparency and insight for navigating today's global capital markets. As the creator of the world's first electronic stock market, its technology powers more than 90 marketplaces in 50 countries, and 1 in 10 of the world's securities transactions. Nasdaq is home to approximately 3,900 total listings with a market value of approximately $13 trillion. To learn more, visit: business.nasdaq.com.

RSS Feeds

RSS Feeds Product Login

Product Login