Nasdaq TradeGuard

A Comprehensive Solution for All Levels of Risk Management

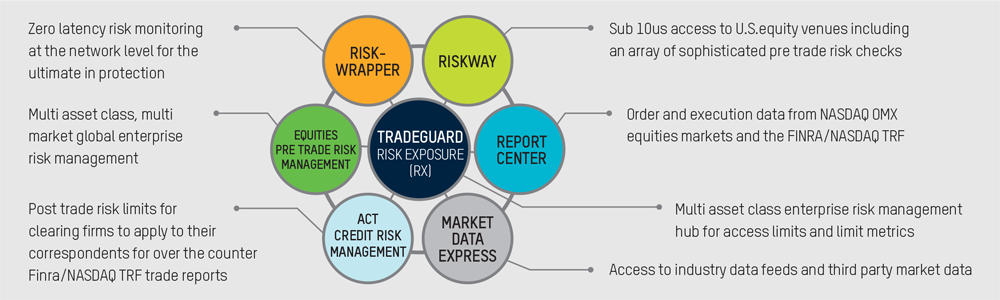

TradeGuard is a comprehensive full-service risk management suite offering a range of tools to address the complex trading landscape. TradeGuard will allow customers to pick and choose from a broad product suite for a range of support, from building a custom risk solution to simply filling in gaps in a current solution. In addition to the current enterprise and Nasdaq exchange risk tools available, the new suite also features monitoring for new markets and asset classes, improved gateways, and supplemental risk monitoring systems. Whether you’re a broker, sponsor, hedge fund, or clearing firm – TradeGuard has the products and services to meet your needs with price points that match your budget.

To learn more about how TradeGuard can help protect your business, contact Patrick Egan at +1 212 231 5733.

RiskWrapper

Zero Latency Risk Monitoring at the Network Level for the Ultimate in Protection

RiskWrapper is designed to measure risk at the network-level by capturing traffic directly from the network to truly measure risk against pre set trading values and thresholds without adding additional latency. RiskWrapper is available through the TradeGuard risk management product suite. RiskWrapper compares the trading activity monitored by your risk management system against all network traffic to identify any abnormal trading.

|

ZERO LATENCY |

RiskWrapper is not in the critical path of the trade, so it doesn't add any additional latency while adding protection |

|

RISK REDUNDANCY |

Compare your risk system against what is actually on the network without interrupting trading On screen and email notification immediately upon detection of any limit breaches |

|

NOTIFICATIONS |

On screen and email notifications immediately upon detection of any limit breaches |

|

VENDOR AGNOSTIC |

As a vendor agnostic product, RiskWrapper can connect to any risk management system - insurance to safeguard firms who have only a homegrown risk solution |

|

LIMITS & MONITORING |

Portfolio limits Single Order value Net notional value across symbol, portfolio or risk group as defined by user Duplication detection Throttling |

Contact Information

- Patrick Egan at +1 212 231 5733.

RSS Feeds

RSS Feeds Product Login

Product Login