Nasdaq TradeGuard

A Comprehensive Solution for All Levels of Risk Management

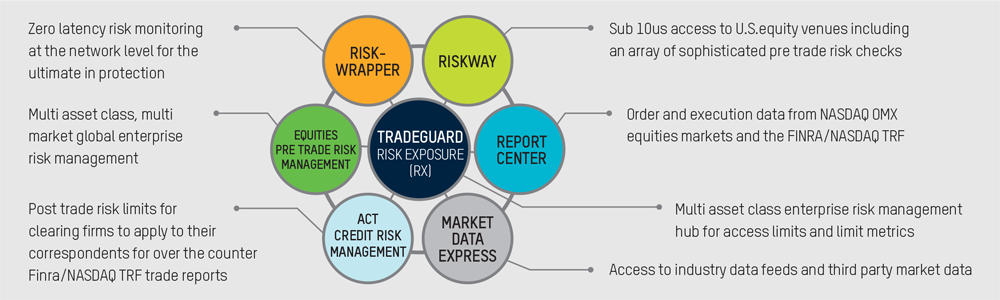

TradeGuard is a comprehensive full-service risk management suite offering a range of tools to address the complex trading landscape. TradeGuard will allow customers to pick and choose from a broad product suite for a range of support, from building a custom risk solution to simply filling in gaps in a current solution. In addition to the current enterprise and Nasdaq exchange risk tools available, the new suite also features monitoring for new markets and asset classes, improved gateways, and supplemental risk monitoring systems. Whether you’re a broker, sponsor, hedge fund, or clearing firm – TradeGuard has the products and services to meet your needs with price points that match your budget.

To learn more about how TradeGuard can help protect your business, contact Patrick Egan at +1 212 231 5733.

ACT Credit Risk Management

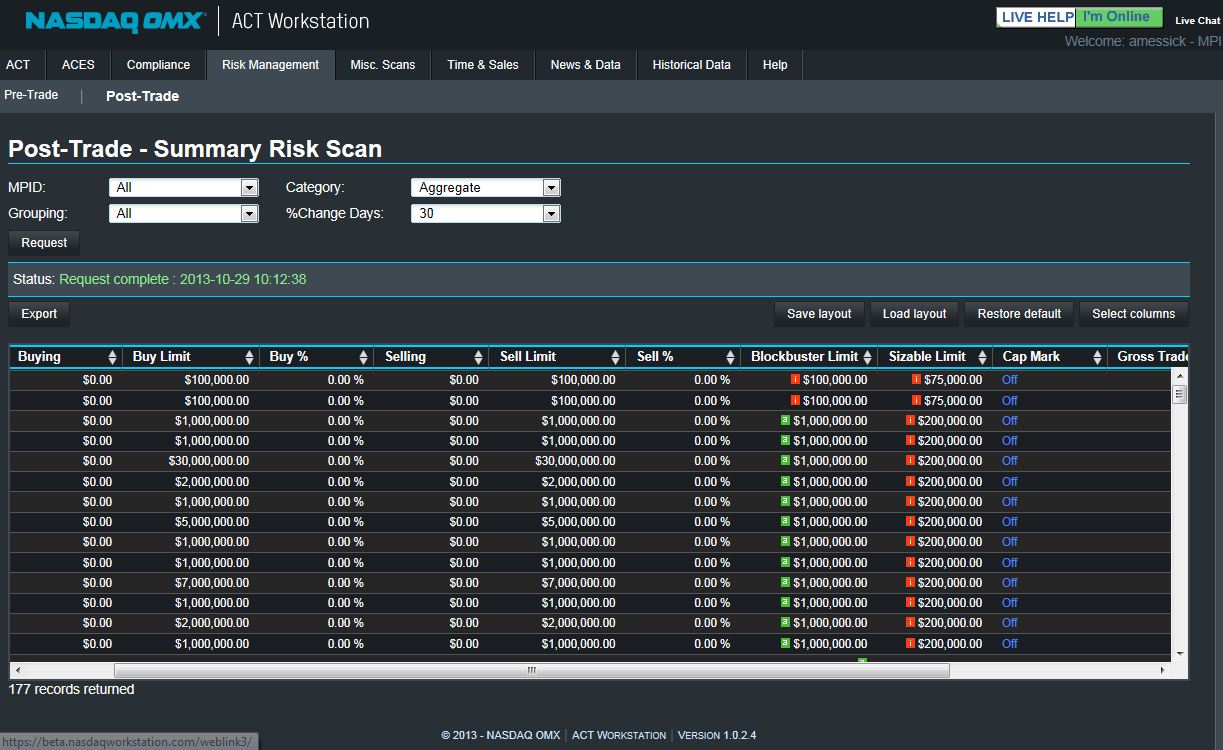

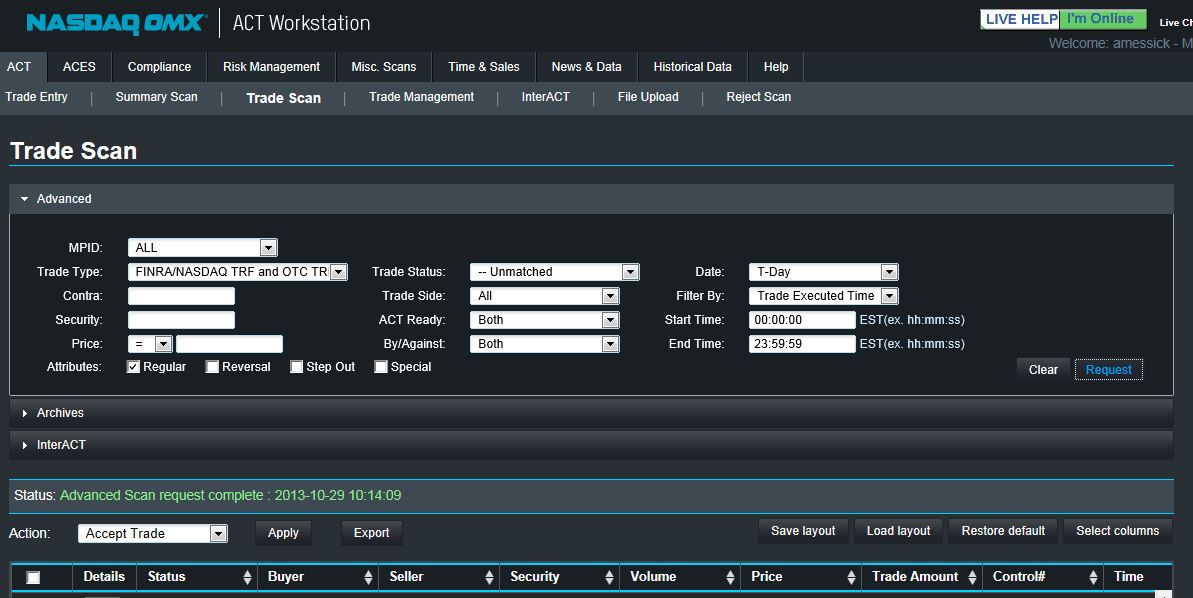

Nasdaq's ACT Workstation for Clearing Firms is an inexpensive browser-based application that assists firms in more easily managing their risk exposure. The ACT Workstation requires internet or extranet connectivity.

Features & Functionality

- Intuitive graphical user interface (GUI)

- Refined total buying and selling power limits

- Blockbuster and sizeable limit settings

- Trade notifications can be delivered through email and cell phone

- Elect to “hold’ trades for your review

- Manage your summary risk exposure by market participant and security

- Enhanced trade entry with clearing price and improved trade analysis, including VWAP and Total Trade Price

- Searches will offer historical trade dates, return up to 2,000 trades for each search and provide sorting and filtering capabilities

- Trade searches can be exported to Excel and PDF

View ACT Workstation Screen Shots

Contact Information

- Patrick Egan at +1 212 231 5733.

In The Press

|

RSS Feeds

RSS Feeds Product Login

Product Login