Tuesday, June 2, 2015

Equity Technical Update #2015 - 8

ACTION REQUIRED: Nasdaq Updates FIX and CTCI TRF Specifications for FINRA Amendments

Category:

Markets Impacted:Contact Information:

Resources: |

Effective Monday, July 13, 2015, as referenced in FINRA Regulatory Notice 14-21, the FINRA/Nasdaq TRF will support the amendments to FINRA rules governing the reporting of over-the-counter (OTC) transactions. To support these changes, the FINRA/Nasdaq TRF specifications have been updated. The latest changes for FIX and CTCI are available in the Post-Trade FIX and CTCI Specifications Page. The following have changed since the last update. The FINRA/Nasdaq TRF updated specification changes include:

Nasdaq strongly recommends participants review the specification changes and submit any questions or feedback. Any changes to the specifications will be made on NasdaqTrader.com and communicated via Equity Technical Updates. Please refer to our FAQ regarding the upcoming changes. NTF Testing InformationThe highlighted changes in the Nasdaq Test Facility (NTF) are available for testing by market participants. Street-Wide Testing Information The street-wide testing schedule has been updated as follows:

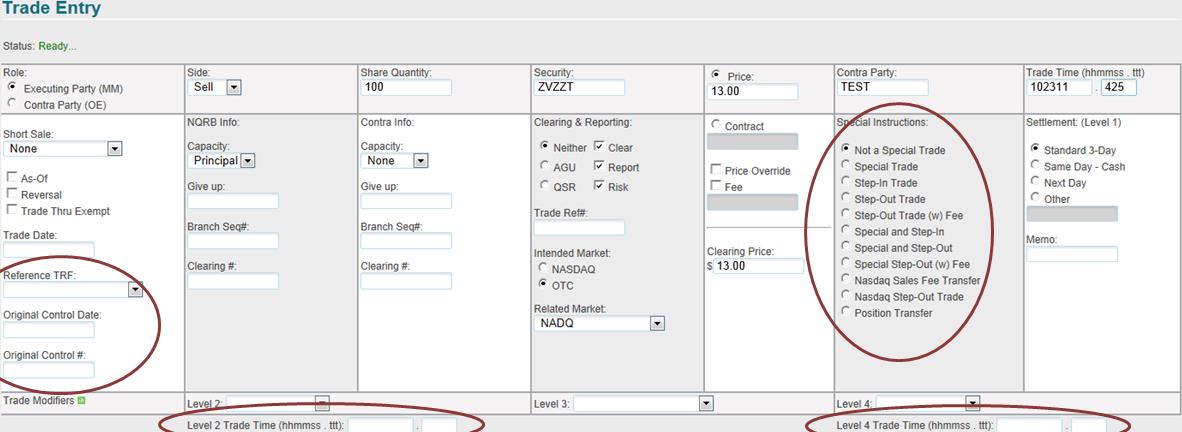

Please review the specification changes and prepare your systems as appropriate. Please contact U.S. Market Operations at +1 212 231 5180 or FINRA Market Operations at +1 866 766 0800 with any questions. Impact on Web Based Trading ApplicationsWeblink ACT 3.0 and File Upload

Equity Trade Journal

Compliance Applications (Reg Recon, Short Sale Monitor, Limit Locator and InterACT)

*** Updated specification pages and FAQs for these products will be available soon.

FINRATM, Trade Reporting FacilityTM and TRFTM are trademarks of Financial Industry Regulatory Authority, Inc.

|

|---|

Email Alert Subscriptions:

Nasdaq offers customers the ability to self select news delivery across various Nasdaq markets. Create and maintain a profile for updating alert preferences and contact information. Visit the enrollment form on the Nasdaq Trader website and sign up today! Please note that if you choose to unsubscribe from an email list, you may no longer receive potentially critical emails from the NASDAQ Stock Market regarding Nasdaq's trading and data products, regulatory issues or marketplace initiatives. To unsubscribe, also click on the enrollment form

Please follow Nasdaq on ![]() Facebook

Facebook ![]() RSS and

RSS and

![]() Twitter.

Twitter.

Nasdaq (Nasdaq: NDAQ) is a leading global provider of trading, clearing, exchange technology, listing, information and public company services. Through its diverse portfolio of solutions, Nasdaq enables customers to plan, optimize and execute their business vision with confidence, using proven technologies that provide transparency and insight for navigating today's global capital markets. As the creator of the world's first electronic stock market, its technology powers more than 90 marketplaces in 50 countries, and 1 in 10 of the world's securities transactions. Nasdaq is home to approximately 3,900 total listings with a market value of approximately $13 trillion. To learn more, visit: business.nasdaq.com.

RSS Feeds

RSS Feeds Product Login

Product Login